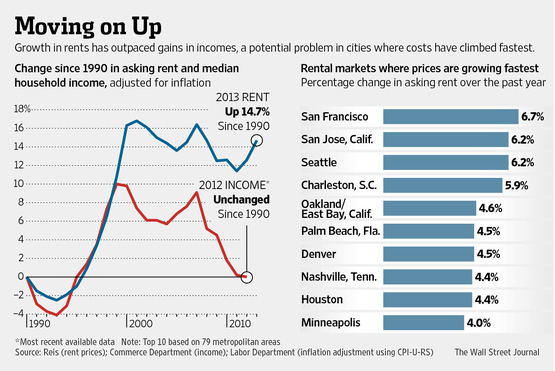

Nationally, apartment rents rose 0.8% in the second quarter from the first quarter. This is the 18 consecutive quarterly rent increase. Over the last 12 months, apartment rents rose 3.4% and vacancies are now 4.1%. The average rent is $1,099.

While rents are rising, incomes have remained stagnate. The median household income was $50,017 in 2012 vs $55,627 in 2007after adjusting for inflation.

With mortgage rates near historic lows, now is an attractive time to buy a home.

Apartment Rents Rise as Incomes Stagnate

Apartment landlords continued to push through hefty rent hikes in the second quarter, squeezing U.S. households that already are struggling financially after four years of steady increases.

The average monthly rent for an apartment rose to $1,099 in the second quarter, up 0.8% from the first quarter, according to data to be released Wednesday by real-estate research firm Reis Inc.REIS +0.96% That was the 18th consecutive quarter of rent increases. For the 12-month period ended in June, rents rose 3.4%.

Effective rents—which tend to be lower than asking rents—were up in all 79 U.S. metro areas tracked in the Reis report. West Coast cities that have been the model of recovery continued to top the list of highest rent growth for the quarter and over the past 12 months.

Rent growth exceeded 6% over the past year in San Francisco, San Jose and Seattle.

Even cities that aren't normally associated with fast rent growth, such as Charleston, S.C., and Nashville, Tenn., posted strong growth over the year, up about 5% or more for the year.

"You have definitely seen that recovery now spread to all of the major markets around the country, even if some of them were laggards," said Ryan Severino, an economist at Reis. "It's a very pervasive recovery."

Economists said the growing demand for rental housing partly reflects changing preferences among younger renters, who tend to prefer urban areas. But the demand for rentals also reflects tight mortgage-lending standards that have shut out potential homeowners from the market.

"If you can't get into a single-family house and you can't get a mortgage, well, you don't need a mortgage to get an apartment," said Stephanie Karol, an economist at IHS.

But household incomes have stagnated, resulting in a financial squeeze for a growing number of renters. Median household income was $50,017 in 2012, below 2007's peak level of $55,627, after adjusting for inflation, according to U.S. Census Bureau data.