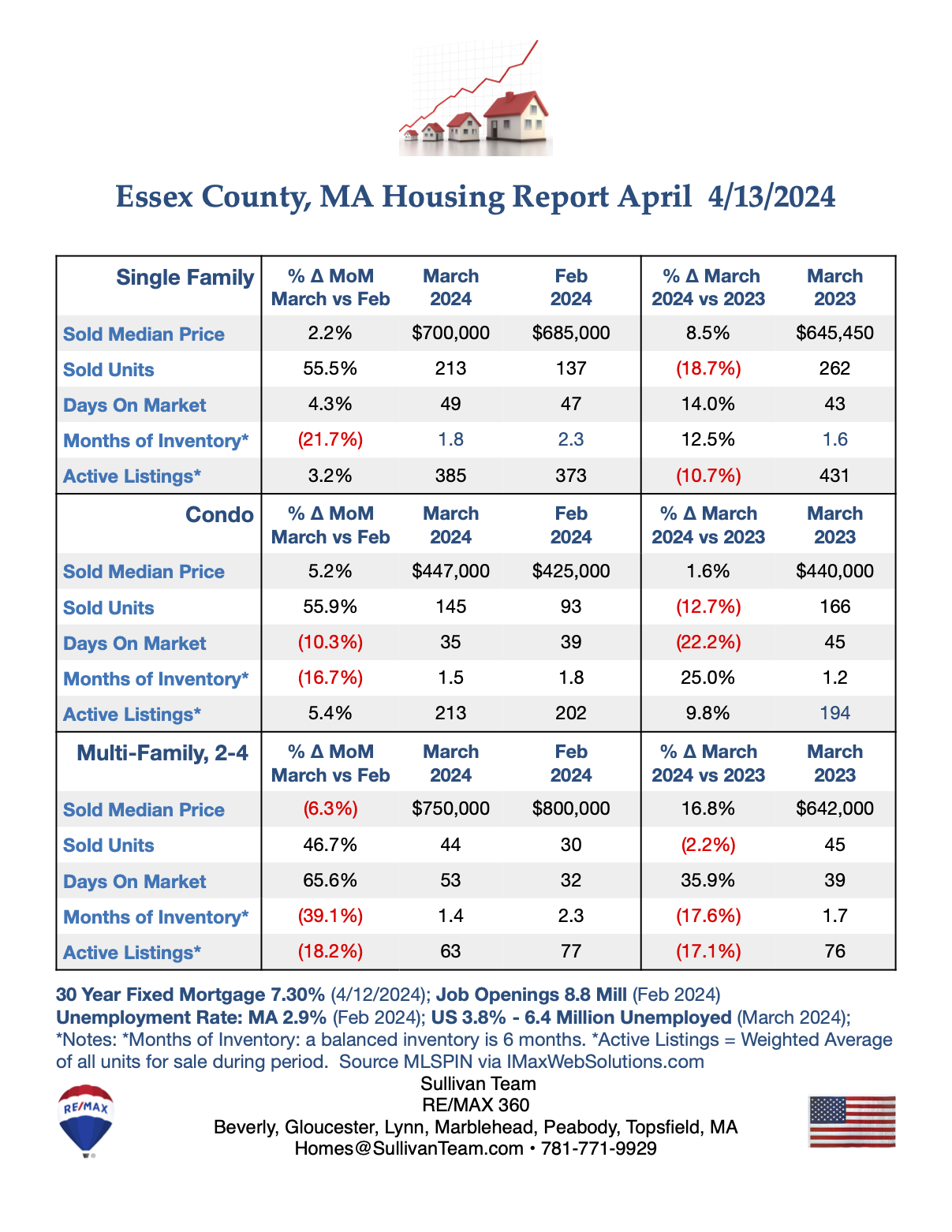

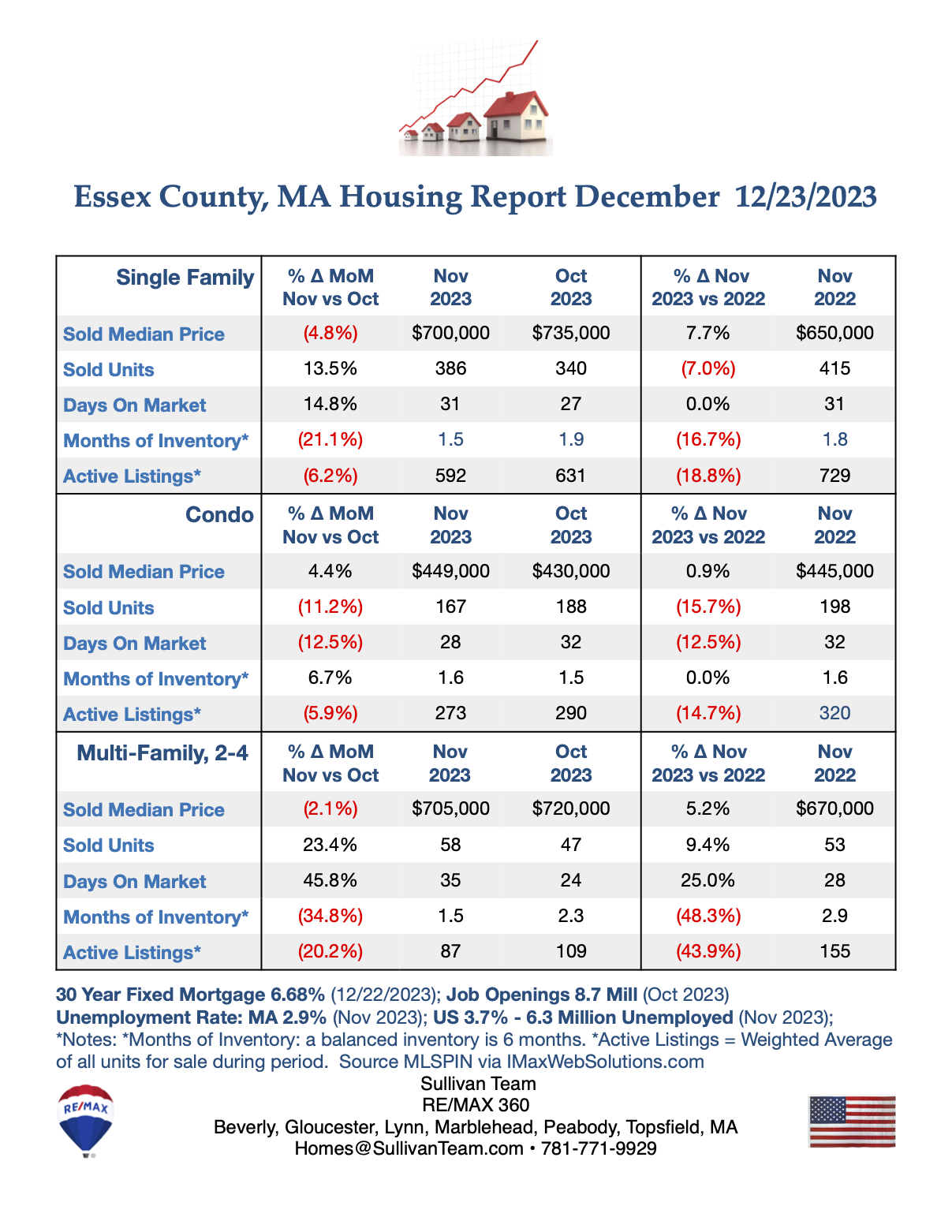

Essex County March Housing Report 4/13/2024

Spring Market is off to a good start with a strong rebound from Feb 2024!

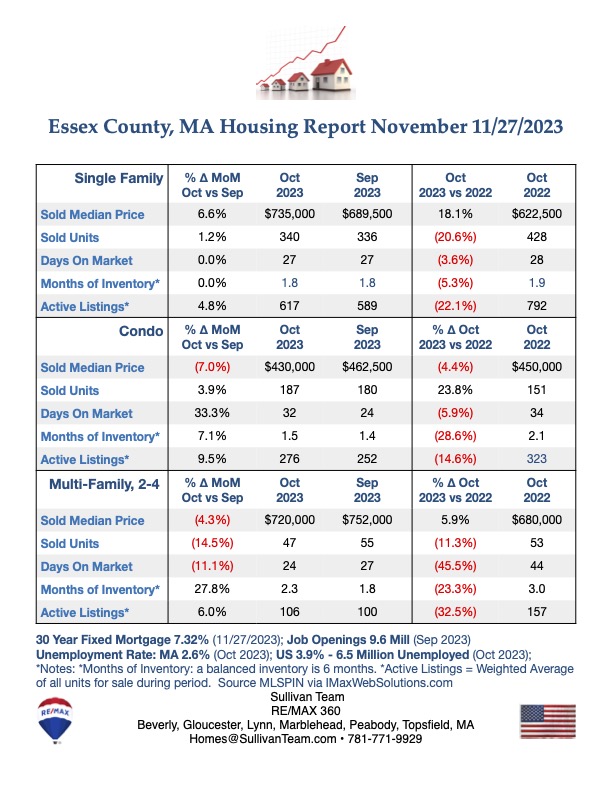

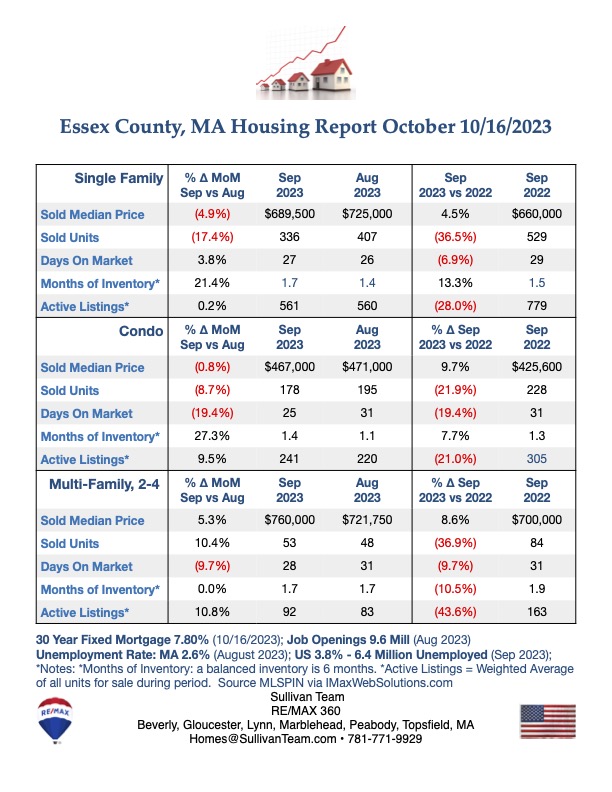

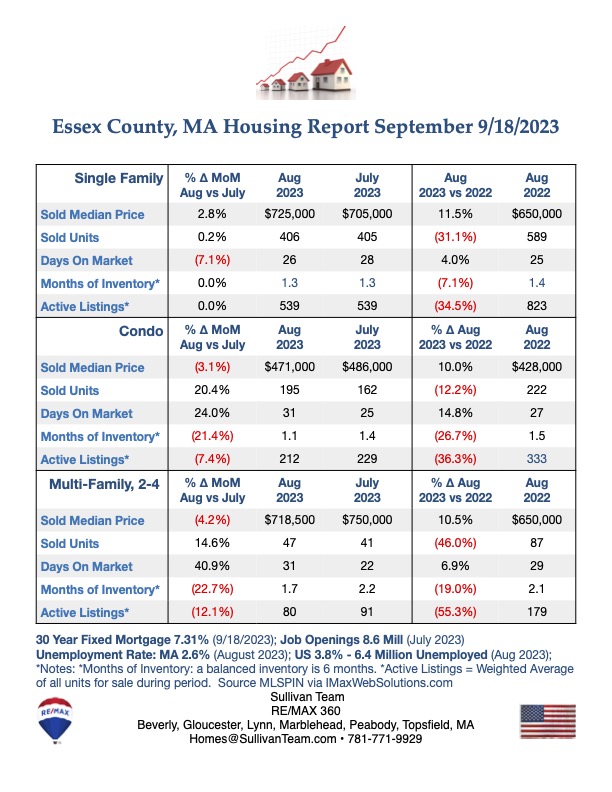

Inflation rose for the third consecutive month. Mortgage rates above 7%. It is unlikely the Federal Reserve will lower interest rates in the near term.

The Consumer Price Index (CPI) and CPI Core Inflation (CPI less food and energy) Indexes both rose in March by 0.4%. Increase was mostly caused by a 0.4% increase in Shelter (housing costs) and a 1.1% increase in Energy costs.

Annual CPI rose 3.5% and Core Inflation rose 3.8%, almost twice the Federal Reserve’s goal of 2% making interest rate cuts unlikely.

30 year fixed rate mortgages now 7.30%, Mortgage News Daily.

Record low inventories continue to support housing prices with not much relief insight

Interest rates remain above 7% discouraging potential sellers with existing low mortgage rates to sell their homes and move.

- To view data for every Essex County town, http://www.sullivanteam.com/Properties/Reports/Public/Charts.php

- To Download the full housing report go to: http://sullivanteam.com/pages/EssexCountyHousingReports