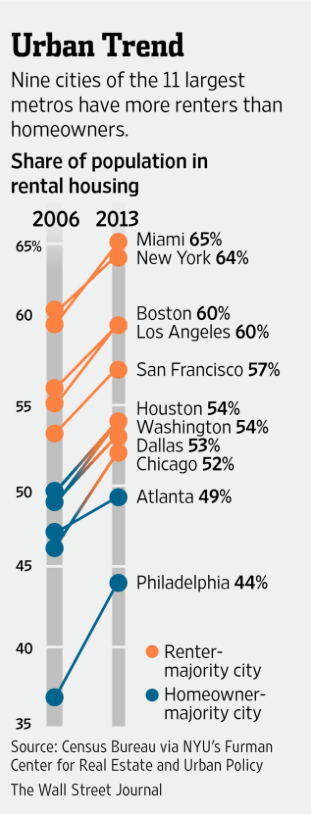

Renters made up the majority of the population in cities at the core of nine of the nation’s 11 largest metro areas in 2013, a sharp change from 2006, when renters were the majority in just five of those cities, according to a new report.

Cities have always had a larger number of renters when compared with suburban areas, in part because the cost of owning a home within a city’s limits is out of reach for many residents, especially in high-cost places such as New York, San Francisco and Washington, D.C.

A resulting demand for apartments is rising so fast that it is starting to overwhelm supply in many cities, which is pushing up housing costs nationwide. “As the number of renters grow, if the supply of rental housing does not keep up—as it has not in most of these cities—then vacancy rates will fall, rents will rise, and more renters will struggle with the costs of housing,” said Ingrid Gould Ellen, the Furman Center’s faculty director.

In some cases, the rise in the number of renters reflects a reversion to levels before the housing boom, when easy credit and no-down-payment mortgages allowed many renters to become homeowners. Once the boom turned to bust, people went back to renting, either because they lost their homes to foreclosure or they became skittish about owning. In Chicago, renters made up 53% of the population in 1990, then dropped to 46% at the height of the housing boom in 2006 and returned to 52% in 2013.

In other cases, long-term demographic trends and changing attitudes have diminished the appeal of the traditional American dream of homeownership. In Houston, just 41% of the population were renters in 1970. The rate rose to 51% by 2000 then declined slightly during the housing boom before starting to rise again, hitting 54% in 2013.

But for many, slow income growth and a lack of savings are the main reasons for renting instead of buying, even as mortgage rates remain historically low. Accumulating savings has become even more difficult as rents rise in many cities. Rents outpaced inflation in all of the 11 cities except for Dallas and Houston, where they remained largely flat, according to the NYU-Capital One report. Rents rose the most in Washington, D.C., over the seven-year period, with a 21% increase in the median rent when adjusted for inflation.