Best 6 months of job growth since 2006

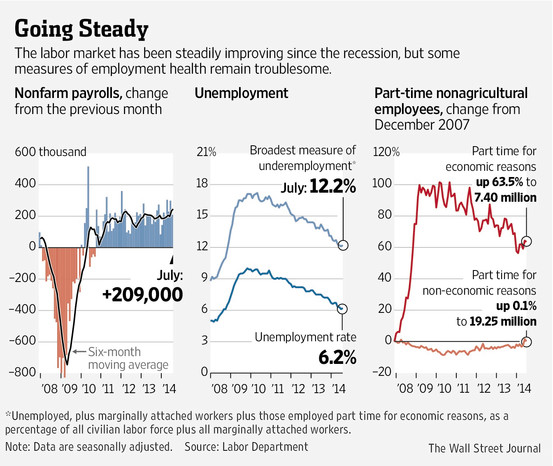

July added 209,000 new jobs, Unemployment was 6.2% ( 9.7 million unemployed) which was the best 6 month job growth since 2006.

Major concerns: A. The Under-employment rate is 12.2%, B. the Labor Participation Rate is near a 40 year low at 62.9% and C. Wage Growth is stagnant when adjusted for inflation. The unemployment rate for those with a high school diploma was 9.6% vs 3.1% for college graduates.

Hiring Settles Into Steady Gains

U.S. businesses added jobs at a sturdy pace last month, extending the most robust stretch of hiring since before the recession.

The question now: Is this the beginning of a breakout in hiring that will lift wage growth and finally bring unemployment down to levels consistent with a healthy economy?

In all, employers ranging from retail stores and professional offices to factories and construction sites last month added a total of 209,000 jobs, when adjusted for seasonal factors, the Labor Department said Friday.

That marked a downturn from the 298,000 jobs created in June, but was more than enough to yield the strongest six months of payroll gains since 2006. July was the first time since 1997 that employers added 200,000 or more jobs in six consecutive months.

Many scars from the financial crisis remain: 9.7 million Americans are out of work, and wage growth—closely watched by the Federal Reserve and others—didn't budge last month. Average hourly earnings for private-sector workers rose just 2% in July over last year, in line with the sluggish trend since the recession.

Wage growth should accelerate as the labor market tightens, chief U.S. economist Maury Harris said, "but the data don't show it yet."

July unemployment rates tick up from 6.1% in June to 6.2%. Wages rise slightly, but not in line with inflation. WSJ's Josh Zumbrun and Phil Izzo join Simon Constable on the News Hub to discuss.

Is job creation at this level in July's jobs report sustainable, and are there any headwinds brewing that could get in the way? Fiduciary Trust Chief INvestment Officer Ronald J. Sanchez joins MoneyBeat with Paul Vigna.

Still, the July numbers gave more evidence of healing across wide swaths of the labor market. Even an uptick in the unemployment rate—to 6.2%—was in part a sign of vigor as more people are now seeking work.

The jobs recovery has been markedly uneven, a dynamic that promises to weigh on consumers and keep the Fed—which has kept short-term interest rates near zero since December 2008 to bolster the U.S. economy through a financial crisis, a deep recession and a lackluster recovery—on alert.

Fed Chairwoman Janet Yellen last month told lawmakers the Fed had been fooled before by "false dawns" and officials "need to be careful to make sure the economy is on a solid trajectory before we consider raising interest rates."

The national unemployment rate ticked up in July partly because more people started looking for jobs and were counted as unemployed, while they previously hadn't been counted as part of the workforce at all. The labor-force participation rate remained near its lowest level in decades, but its decline has leveled out and it edged up last month to 62.9% from 62.8% in June.

A third of America's unemployed—3.2 million people—have been out of work for more than six months. An additional 7.5 million people were working part-time jobs last month because they couldn't find full-time work. A broad measure of unemployment that includes those part-timers and people marginally attached to the labor force was 12.2% in July.

Adults with a college degree enjoyed a 3.1% unemployment rate, while people without a high-school diploma faced unemployment of 9.6%.